DEALS ANALYSIS

Digital media and ecommerce deals see growth in a slow year for packaging deals

Powered by

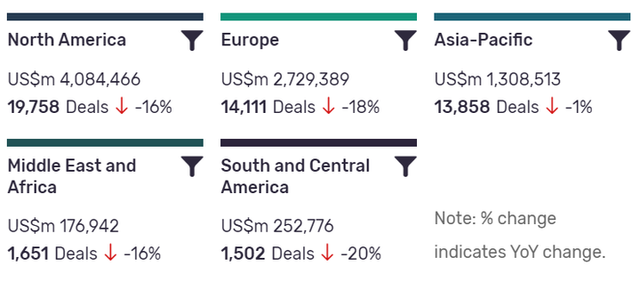

Deals activity by geography

Packaging industry deals, as captured by GlobalData’s Packaging Intelligence Centre, are down year-on-year (YoY) across all regions.

South and Central America has seen the biggest drop, with the volume of deals down -20% YoY. North America is leading in terms of deals value, but the volume of deals is also down -16% YoY. Asia-Pacific, ranking third in terms of deal value, only saw a drop of -1% in deals volume.

The volume of deals recorded by GlobalData also dropped YoY in Europe (18%) and Middle East and Africa (-16%).

Deals activity by theme

GlobalData’s analysis of packaging industry deals by theme shows that digital media and ecommerce have seen growth in terms of deal volumes year on year, while the number of internet of things (IoT) and artificial intelligence-related deals has dropped.

In terms of deal value, digital media deals have almost doubled from $16.5bn in 2019 to $27.4bn in 2020. The value of IoT-related deals have increased from $1.5bn in 2019 to $5bn in 2020.

| Deals value by theme | 2019 | 2020 |

| Digital media | $16.5bn | $27.4bn |

| IoT | $1.5bn | $5bn |

| AI | $4.2bn | $2.6bn |

| Ecommerce | $747.4bn | $637.2bn |

Deals activity by type

| Deal type | Total deal value ($m) | Total Deal Count | YOY change (volume) |

| Acquisition | 3852212 | 20433 | -18% |

| Asset Transaction | 782871 | 5968 | -42% |

| Equity Offering | 576620 | 5662 | 36% |

| Venture Financing | 49980 | 5248 | 16% |

| Private Equity | 760662 | 4873 | -36% |

| Debt Offering | 1980737 | 3830 | 45% |

| Partnership | 18706 | 3212 | 859% |

| Merger | 285379 | 530 | -61% |

A breakdown of deals by type and volume shows huge growth in partnerships (859%) YoY, while mergers and acquisitions are down -61% and -18% respectively, and asset transactions are down -41%. Financing deals have increased across some types, with debt offerings up 45%, equity offerings up 36% and venture financing up 16%. Private equity, however, has seen a drop of -36% in number of deals YoY.

Note: All numbers as of 26 October 2020. Deals captured by GlobalData cover M&As, partnerships and capital raisings.

For more insight and data, visit GlobalData's Packaging Intelligence Centre.

Latest deals in brief

Coca-Cola European Partners eyes Indonesia with $6.6bn Coca-Cola Amatil bid

Coca-Cola European Partners (CCEP) has identified Indonesia as the "standout" target in its proposed swoop for Australasian bottler Coca-Cola Amatil. The company, which announced a bid that values CCA at AUD9.28bn ($6.6bn), said Indonesia's demographics and growth potential make it a key component of the deal. "It is one of the most exciting and populous emerging markets," said CCEP chief executive Damian Gammell.

Nordic Paper Files to raise up to $201.62m in a private placement of shares

Nordic Paper Holding AB, a producer of kraft and greaseproof paper, has filed a prospectus to raise up to SEK1.77bn ($201.62m) in private placement of 34,123,488 existing shares at a price of SEK40-52 ($4.5-5.9) per share by Shanying International Holding Co., Ltd (through Sutriv Holding AB).

Covestro to acquire resins and functional materials businesses from Royal DSM

Covestro AG, a Germany-based company that manufactures and markets polymers and plastic materials, has entered into an agreement to acquire Royal DSM's resins and functional materials businesses. Covestro agreed a deal with Royal DSM NV, the Netherlands-based provider of nutritional products, engineering plastics, and anti-reflective coatings, for an equity value of €1.6bn ($1.8bn).

Suzano raises $750m in public offering of 3.75% bonds due 2031

Suzano Austria GmbH, an Austrian paper products manufacturing company that provides packaging, sanitary, printing, and writing paper products, has raised $750m in a public offering of 3.75% bonds due 2031. The bonds will mature on 15 January 2031.

Shanying International Holdings (Anhui Shanying Paper Industry) to raise $736.9m in private placement of shares

Shanying International Holdings Co Ltd (Anhui Shanying Paper Industry Co Ltd), a China-based manufacturer and distributor of paper products, has announced to raise CNY5bn ($736.9m) through an issue of 1,378,663,756 shares at a price of CNY3.62 ($0.53) per share in private placement.

Reynolds Group (Pactiv Evergreen) orices initial public offering of common stock for USD

Reynolds Group Holdings Limited (Pactiv Evergreen Inc), a New Zealand-based manufacturer and supplier of consumer beverage and food service packaging products, has announced the pricing of its initial public offering of 41,026,000 shares of its common stock at a price to the public of $14.00 per share.