DEALS ANALYSIS

Ecommerce and IoT deals lead the way in a slow start to the year for packaging deals

Powered by

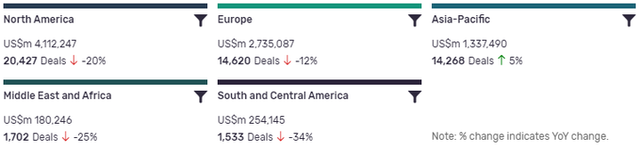

Deals activity by geography

Packaging industry deals, as captured by GlobalData’s Packaging Intelligence Centre, are down year-on-year (YoY) across the majority of regions.

South and Central America has seen the biggest drop, with the volume of deals down -34% YoY. North America is leading in terms of deals value, but the volume of deals is also down -20% YoY. The volume of deals recorded by GlobalData also dropped YoY in Europe (-12%) and Middle East and Africa (-25%).

Asia-Pacific, ranking third in terms of deal value, saw a slight increase of 5% in deals volume.

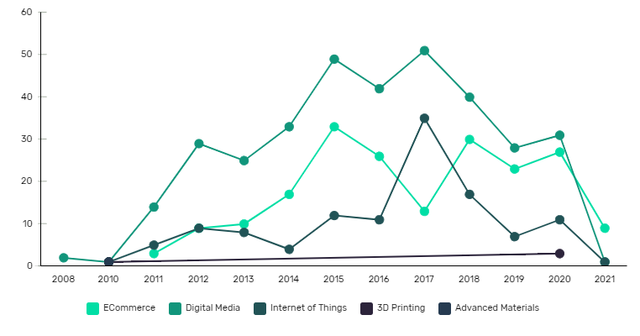

Deals activity by theme

GlobalData’s analysis of packaging industry deals by theme shows that, although only a couple of months into the year, ecommerce has seen a strong start in terms of deal volumes year on year. This is understandable, as companies have shifted to online operations in response to the Covid-19 pandemic.

| Deals value by theme | 2020 | 2021 |

| Digital media | $27.5bn | $10.3m |

| IoT | $11bn | $26.8m |

| Ecommerce | $9.4bn | $289.4m |

| 3D printing | $3bn | – |

Deals activity by type

| Deal type | Total deal value ($m) | Total Deal Count | YOY change (volume) |

| Acquisition | 3,880,771 | 21,114 | -3% |

| Asset Transaction | 791,747 | 6,104 | -61% |

| Equity Offering | 591,166 | 5,810 | 28% |

| Venture Financing | 52,500 | 5,581 | 14% |

| Private Equity | 788,729 | 5,139 | 10% |

| Debt Offering | 1,994,128 | 3,867 | 63% |

| Partnership | 18,196 | 3,220 | 5585% |

| Merger | 272,068 | 558 | -97% |

A breakdown of deals by type and volume shows huge growth in partnerships (5585%) YoY, while mergers and acquisitions are down -97% and -3% respectively, and asset transactions are down -61%. Financing deals have increased across some types, with debt offerings up 63%, equity offerings up 28%, and venture financing up 14%. Private equity, has seen an increase of 10% in number of deals YoY.

Note: All numbers as of 19 February 2021. Deals captured by GlobalData cover M&As, partnerships and capital raisings.

For more insight and data, visit GlobalData's Packaging Intelligence Centre.

Latest deals in brief

American Industrial Partners to Acquire Personal Care Business from Domtar

American Industrial Partners, a private equity firm, has announced to acquire personal care business from Domtar Corp, a manufacturer and marketer of uncoated freesheet papers, for a consideration of $920m. Both companies involved in the transaction are based in the US.

Essity Raises $849.47m in Offering of Bonds Due 2031

Essity AB, a Sweden-based hygiene and health company that offers one-use products such as tissue paper, baby diapers, feminine care, and incontinence products, has raised €700m ($849.47m) in offering of bonds.

Coca-Cola May Sell South African Bottling Unit

According to Bloomberg, The Coca-Cola Co, a US-based producer, distributor, and marketer of non-alcoholic beverages, may sell a stake in its South African bottling unit to local investors in a deal worth about ZAR10bn ($666.2m).

Silgan Holdings Prices Offering of 1.4% Senior Secured Notes Due 2026 for $500m

Silgan Holdings Inc, a US-based supplier of sustainable rigid packaging solutions for consumer goods products, has priced offering of 1.4% Senior Secured Notes due 2026 for $500m.

Apollo Global Management to Acquire Aluminum Can and Aluminum Rolling Business from Showa Denko

Funds managed by affiliates of Apollo Global Management Inc, a US-based private equity firm, has announced to acquire the aluminum can and aluminum rolling businesses from Showa Denko KK, a Japan-based chemical company that provides individualised products including petrochemicals, chemicals, carbon, ceramics, and aluminum products. According to DealStreetAsia, the transaction is expected to be valued at JPY50bn ($481.5m).

Bain Capital May Acquire Parksons Packaging

According to DealStreetAsia, Bain Capital LP, a US-based private equity firm, may acquire Parksons Packaging Ltd., a India-based packaging material manufacturer, for a consideration of INR3,000 crore ($410.7m).