DEALS ANALYSIS

Asia-Pacific shows growth amidst decline across most regions for packaging deals

Powered by

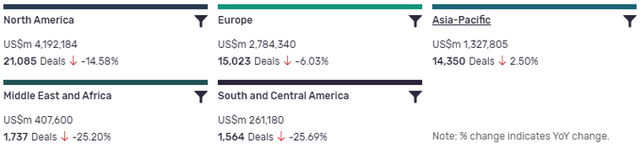

Deals activity by geography

Packaging industry deals, as captured by GlobalData’s Packaging Intelligence Centre, are down year-on-year (YoY) across the majority of regions.

South and Central America has seen the biggest drop, with the volume of deals down -25.69% YoY. North America is leading in terms of deals value, but the volume of deals is also down -14.58% YoY. The volume of deals recorded by GlobalData also dropped YoY in Europe (-6.03%) and Middle East and Africa (-25.2%).

Asia-Pacific, ranking third in terms of deal value, saw a slight increase of 2.5% in deals volume.

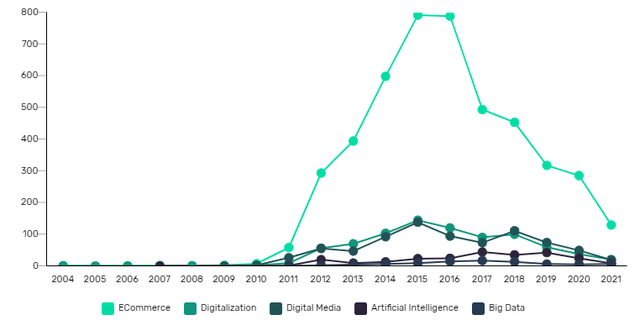

Deals activity by theme

GlobalData’s analysis of packaging industry deals by theme shows that investing in ecommerce operations and Future of Work practises has seen a strong start in terms of deal volumes YoY. This is understandable, as companies have shifted to remote operations in response to the Covid-19 pandemic.

| Deals value by theme | 2021 | 2020 |

| Ecommerce | $16,619.30m | $30,042.00m |

| Digitalization | $6,992.40m | $25,350.40m |

| Internet of Things | $4,534.80m | $1,274.80m |

| Artificial Intelligence | $1,228.20m | $1,238.60m |

| Digital Media | $200.40m | $10,734.80m |

Deals activity by type

| Deal type | Total deal value ($m) | Total Deal Count | YOY change (value) |

| Acquisition | 4,159,512 | 21,573 | 309.93% |

| Asset Transaction | 796,261 | 6,189 | -50.12% |

| Equity Offering | 612,944 | 6,014 | 10.79% |

| Venture Financing | 57,020 | 6,001 | 26.77% |

| Private Equity | 801,653 | 5,281 | -128.27% |

| Debt Offering | 2,062,356 | 4,018 | -26.75% |

| Partnership | 18,221 | 3,239 | -98.98% |

| Merger | 227,693 | 582 | -94.75% |

A breakdown of deals by volume shows huge growth in acquisitions (309.93%) YoY, while equity offerings (10.79%) and asset transactions (26.77%) are similarly up YoY. However, debt offering deals are down YoY (-26.75%) as well as asset transactions (-50.12%). Mergers (-94.75%), partnerships (-98.98%), and private equity deals (-128.27%) are also down YoY.

Note: All numbers as of June 2021. Deals captured by GlobalData cover M&As, partnerships and capital raisings.

For more insight and data, visit GlobalData's Packaging Intelligence Centre.

Latest deals in brief

Graphic Packaging Holding to acquire AR Packaging Group for $1.45bn

Graphic Packaging Holding Co, a US-based provider of paper based packaging solutions, has agreed to acquire AR Packaging Group AB, a Sweden-based provider of packaging services, from CVC Capital Partners Fund VI, a Luxembourg-based subsidiary of CVC Capital Partners, for cash consideration of $1.45bn.

Intertape Polymer prices $400m in offering of bonds

Intertape Polymer Group Inc, a specialty packages providing company that develops and manufactures specialized polyolefin, plastic, paper, and film-based packaging products, has priced $400m in offering of bonds.

Constantia Flexibles Group acquires Propak Ambalaj Uretim ve Pazarlama for €120m

Constantia Flexibles Group GmbH, an Austria-based manufacturer of flexible packaging, has acquired Propak Ambalaj Uretim ve Pazarlama A.S., a manufacturer of flexible packaging products for food markets, from Polinas Plastik Sanayii ve Ticareti A.S. for €120m.

Ranpak Holdings prices public offering for $105m

Ranpak Holdings Corp, a US-based provider of protective paper packaging materials and systems, has priced its underwritten registered public offering of 5,000,000 shares of its Class A common stock at a public offering price of $21 per share.

Mega First to acquire 100% stake in Stenta Films for $49.44m

Mega First Corp Bhd has announced intentions to acquire a 100% stake in Stenta Films Sdn. Bhd., a manufacturer of flexible packaging film, for MYR205m ($49.44m). Both companies are based in Malaysia.

Shin-Etsu Polymer to acquire food packaging wrapping film business from Showa Denko Materials

Shin-Etsu Polymer Co. Ltd. has announced intentions to acquire the food packaging wrapping film business from Showa Denko Materials Co Ltd, a diversified chemical company that undertakes the manufacture and sale of advanced performance and electronic related products, for JPY3.666bn ($33.72m).