DEALS ANALYSIS

Digital media and ecommerce deals see growth in a slow year for packaging deals

Powered by

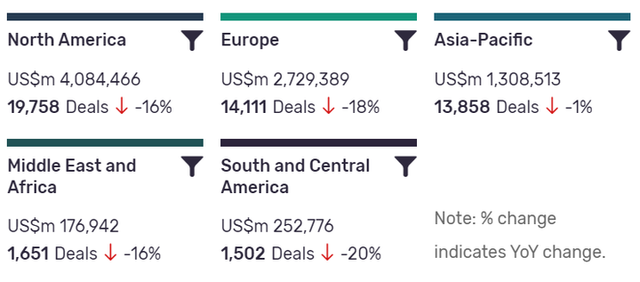

Deals activity by geography

Packaging industry deals, as captured by GlobalData’s Packaging Intelligence Centre, are down year-on-year (YoY) across all regions.

South and Central America has seen the biggest drop, with the volume of deals down -20% YoY. North America is leading in terms of deals value, but the volume of deals is also down -16% YoY. Asia-Pacific, ranking third in terms of deal value, only saw a drop of -1% in deals volume.

The volume of deals recorded by GlobalData also dropped YoY in Europe (18%) and Middle East and Africa (-16%).

Deals activity by theme

GlobalData’s analysis of packaging industry deals by theme shows that digital media and ecommerce have seen growth in terms of deal volumes year on year, while the number of internet of things (IoT) and artificial intelligence-related deals has dropped.

In terms of deal value, digital media deals have almost doubled from $16.5bn in 2019 to $27.4bn in 2020. The value of IoT-related deals have increased from $1.5bn in 2019 to $5bn in 2020.

| Deals value by theme | 2019 | 2020 |

| Digital media | $16.5bn | $27.4bn |

| IoT | $1.5bn | $5bn |

| AI | $4.2bn | $2.6bn |

| Ecommerce | $747.4bn | $637.2bn |

Deals activity by type

| Deal type | Total deal value ($m) | Total Deal Count | YOY change (volume) |

| Acquisition | 3852212 | 20433 | -18% |

| Asset Transaction | 782871 | 5968 | -42% |

| Equity Offering | 576620 | 5662 | 36% |

| Venture Financing | 49980 | 5248 | 16% |

| Private Equity | 760662 | 4873 | -36% |

| Debt Offering | 1980737 | 3830 | 45% |

| Partnership | 18706 | 3212 | 859% |

| Merger | 285379 | 530 | -61% |

A breakdown of deals by type and volume shows huge growth in partnerships (859%) YoY, while mergers and acquisitions are down -61% and -18% respectively, and asset transactions are down -41%. Financing deals have increased across some types, with debt offerings up 45%, equity offerings up 36% and venture financing up 16%. Private equity, however, has seen a drop of -36% in number of deals YoY.

Note: All numbers as of 2 December 2020. Deals captured by GlobalData cover M&As, partnerships and capital raisings.

For more insight and data, visit GlobalData's Packaging Intelligence Centre.

Latest deals in brief

Roth CH Acquisition I to Acquire PureCycle Technologies for $1.2bn

Roth CH Acquisition I, a blank check company, has announced to acquire PureCycle Technologies Inc, a company which offers recycled polypropylene with properties equal to virgin polymer, for a consideration of $1.2bn. Both the companies are based in the US.

Upon closing of the transaction, the newly created holding company will be re-named PureCycle Technologies, Inc. and will be listed on the Nasdaq Capital Market under the new ticker symbol PCT.

Canpack Raises $1.1bn in Private Placement of Notes

Canpack SA, a Poland-based manufacturer of aluminum beverage cans and packaging for the food industry including glass bottles and metal closures, has issued $1.1bn (equivalent in a combination of USD and EUR) senior notes and their listing on the Official List of the Luxembourg Stock Exchange (LuxSE) and admission to trading on the Euro MTF market operated by the LuxSE.

Meilun (BVI) aiming to Raise $1bn in Public Offering of Bonds

Meilun (BVI) Limited, a wholly-owned subsidiary of Shandong Chenming Paper Holdings Limited, has announced it aims to raise $1bn through an issue of bonds.

Shandong Chenming is engaged in manufacture and sales of paper pulp, papermaking and power generation. The term of bonds will be not more than five years and subject to changes in market interest rates and investors’ demand.

Smurfit Kappa Raises $783.14m in Private Placement of Ordinary Shares

The Smurfit Kappa Group plc, an Ireland-based corrugated packaging company engaged in paper-based packaging, has raised €660m ($783.14m) in a private placement, through an issue of 19,411,765 ordinary shares at a price of €34 per Placing Share.

Shanghai Zhizheng Enterprise to Acquire 100% Stake in Shanghai Zhizheng New Material from Shanghai Original Advanced

Shanghai Zhizheng Enterprise Group Co., Ltd. has entered into an equity transfer agreement to acquire 100% stake in Shanghai Zhizheng New Material Co., Ltd., a company engaged in wire and cable manufacturing, from Shanghai Zhizheng Daohua Polymer Material Co., Ltd. (Shanghai Original Advanced Compounds Co.,Ltd.), a company operating as a new cable materials manufacturer, for a cash consideration of $62.6m. All the companies involved in the transaction are based in China.

Probiotec (PBP) to Acquire Multipack-LJM

Probiotec, Ltd. (PBP), a manufacturer, marketer and distributor of prescription and over-the-counter pharmaceuticals, complementary medicines and specialty ingredients, has announced to acquire Multipack-LJM Pty., Ltd., a provider of packaging services for food and beverage, personal care and household and pharmaceutical companies, for a consideration of $52.5m. Both the entities are based in Australia.