Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 7 July

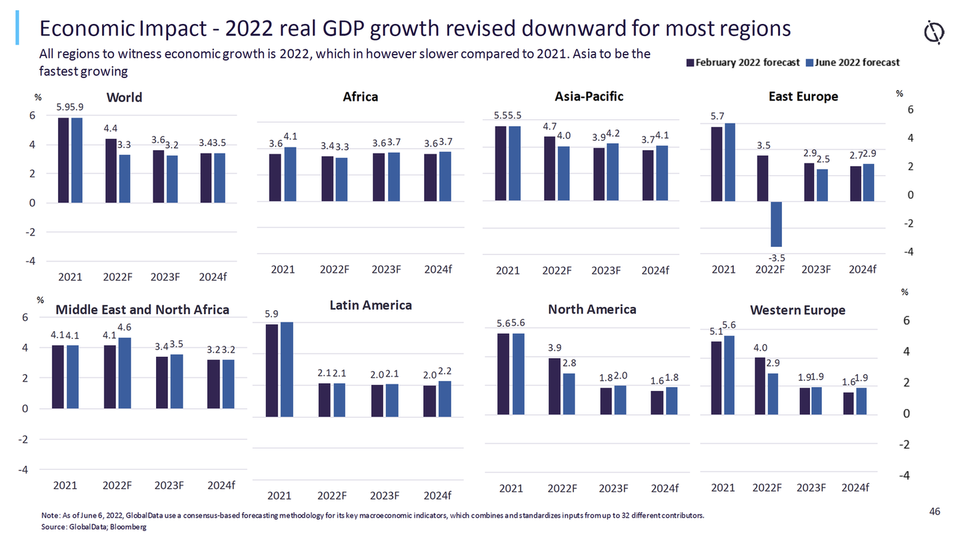

GlobalData forecasts the world economy will grow at a slower pace of 3.3% in 2022 following 5.9% growth in 2021. On the other hand, the global inflation rate is projected to rise to 7% in 2022 from 3.5% in the previous year due to supply chain disruption amid the Ukraine-Russia war.

The widespread closures of packaging and production facilities in Ukraine and Russia— coupled with increasingly stringent sanctions on Russian trade and the ongoing exodus of over 300 major western companies — are having short-term impacts on energy, the price of raw materials and supply chain disruptions. In the longer term, these factors will negatively impact GDP, consumption and packaging demand in both countries. The prolonged invasion has prompted more packaging firms to leave Russia and scale down operations.

Rising glass costs have encouraged brands to reassess alternatives to this pack material. The alcoholic drinks industry has been adversely impacted by lost sales to Russia and Ukraine due to the war, both of whom are key markets for wine and spirits. Higher fuel costs are another burden that will continue to impact the cost of the energy-intensive process of glass production.

- PACKAGING SECTOR IMPACT -

Latest update: 7 July

Supply chain and demand disruption

Wood exports to Europe were already adversely impacted as Russia implemented new export duties and export restrictions in January 2022. Russia hiked export duties to 80% from its World Trade Organization commitment of a maximum of 13% to 15%. The European Federation of Wooden Pallet and Packaging Manufacturers says this could lead to a shortage of pallets in Ukraine hampering the supply chain further. Ukraine currently exports 15 million wooden pallets plus around 2.7 million cubic metres of lumber, which is used for pallet production in France, Germany, Italy, the Netherlands, and Poland. A further 7.6 million cubic metres exported from Belarus and Russia to the EU will be impacted by the export bans.

Since the start of the conflict, many major packaging producers have shut down their facilities in Ukraine, including glass container manufacturers Verallia and Vetropack (who are reliant upon a continuous and reliable source of oil and gas). The Ukrainian paper and board packaging industry has also come to a virtual standstill with major customers and suppliers such as Coca Cola, Nestle, Carlsberg, ABInbev, and ArcelorMittal closing their local operations.

The extension of sanctions and exit of many western companies is resulting in the closure or mothballing of packaging facilities in Russia. Stora Enso has ceased production in Russia at its three corrugated and two wooden pallet plants, while the defacto closure of the food supply chain affected critical Black Sea shipping ports. Nevertheless, shortages of newsprint, kraft-liner, and wood-free papers are expected in Europe.

Sanctions on Russia

Sanctions on Russia will cause commodity prices to rise. Businesses were already facing significant supply disruption during the pandemic. Aside from the sharp rises in oil and gas input prices, paper and board and aluminium prices are currently the most affected, with already high aluminium prices rising to reaching US$4,073 per tonne on 8 March.

Import restrictions on packaging and ingredients for baby food production has prompted the Russian trade ministry to uncover opportunities to replace foreign suppliers. The agriculture ministry has also proposed the government set up export quotas for sunflower oil to “maintain stability.”

Mondi owns the largest Russian paper producer, Mondi Syktyvkar, and earns around 12% of its revenue from the country. The Ruble has stabilised from an initial major fall in value, though its depreciation will bring potential challenges to company exports.

The war in Ukraine has caused a significant reduction in forest product exports from Russia, Belarus, and Ukraine. In 2021, these three countries accounted for nearly 25% of worldwide lumber trade. The war will lead to tighter wood supply and disruptions to shipments

of associated products like wood pellets, wood chips, and pulp.

Companies are leaving Russia

Finnish food packaging provider, Huhtamäki, has announced it will divest its Russian operations after determining the war will hamper long-term growth. The company has four manufacturing units in Russia, employing approximately 700 people and representing approximately 3% of the group’s total sales. Its withdrawal will end 30 years of involvement in Russia.