M&A Deals in Q3

What were the top themes in packaging M&A deals in Q3?

In the three months to the end of September, mergers & acquisitions in the packaging industry were driven by environmental and health & wellness themes. GlobalData picks apart the numbers

Powered by

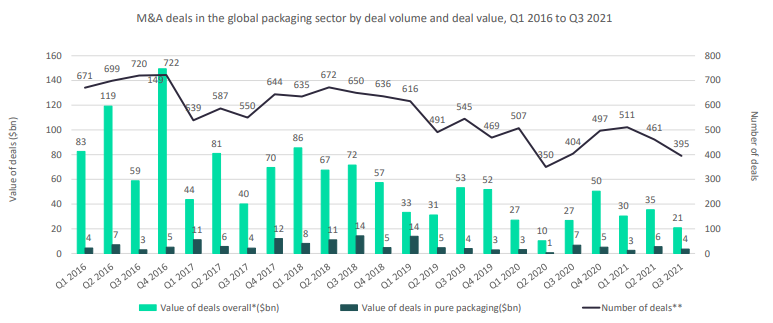

In the third quarter M&A deals were down in both value and volume on the prior three-month period, to the end of June. With 395 packaging deals recorded by GlobalData’s Deals Database, the volume of transactions also registered a year-on-year decline - 404 in Q3 2020. In value terms, the total amount of packaging M&A in the three months to the end of September hit US$21bn, compared to $27bn in the corresponding quarter last year.

The global packaging industry saw nine billion-dollar-plus deals in Q3 2021, compared to eight a year earlier.

The biggest deals and their themes

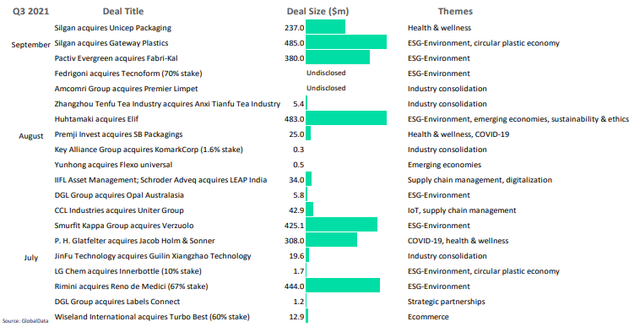

Leading the way on a themes basis in the quarter’s deals activity were ESG-Environment and Health & Wellness.

ESG-Environment

Both regulators and non-governmental initiatives are progressing the packaging sector towards a circular economy. This means gradually decoupling economic activity from the consumption of finite resources and removing waste from the system. Circular economy regulations have been around for decades but are gathering significant momentum.

Huhtamaki to acquire Elif Holding

Deal size - $483m

Finnish food packaging specialist Huhtamaki entered into an agreement to purchase Elif Holding, a Turkey-based manufacturer of flexible packaging for home care products designed to reduce the environmental impact of plastic waste.

Pactiv Evergreen lines up Fabri-Kal buy

Deal size - $380m

Fresh food and beverage packaging manufacturer Pactiv Evergreen secured clearance from Fabri-Kal to purchase the foodservice and consumer brand packaging solutions provider. Fabri-Kal’s Greenware range is made from plants rather than petroleum.

Health & Wellness

Consumers of all ages are proactively addressing their health in a more holistic and personalised manner. Advances in technology have helped consumers stay highly connected around the clock, subsequently raising the awareness of health issues. The health-conscious consumer creates new opportunities for packaging companies.

PH Glatfelter to purchase Jacob Holm & Sons

Deal size - $308m

Glatfelter, a US-based supplier of engineered materials, agreed to acquire Jacob Holm & Sons, a Switzerland-based manufacturer of spun lace nonwoven fabrics for critical cleaning, personal care hygiene, and medical applications.

Silgan Holdings snaps up Unicep Packaging

Deal size - $237m

Cross-category dispensing and speciality closures provider Silgan Holdings bought Unicep Packaging, a provider of single-use packaging for consumer and professional products including diagnostic test components, oral care, skincare and animal health products.